If this post looks familiar, it’s because I ran it in 2020 and 2021, and I’m republishing it today with updated numbers for 2023.

This post is about the most magical time of the year—benefits enrollment!

Early November is benefits enrollment time in my household, so I assume that’s the case for most of you too.

Amid all the chaos of the world around me, I can find solace in the comfort of crunching numbers to see how to best enroll in benefits between my and my wife’s jobs.

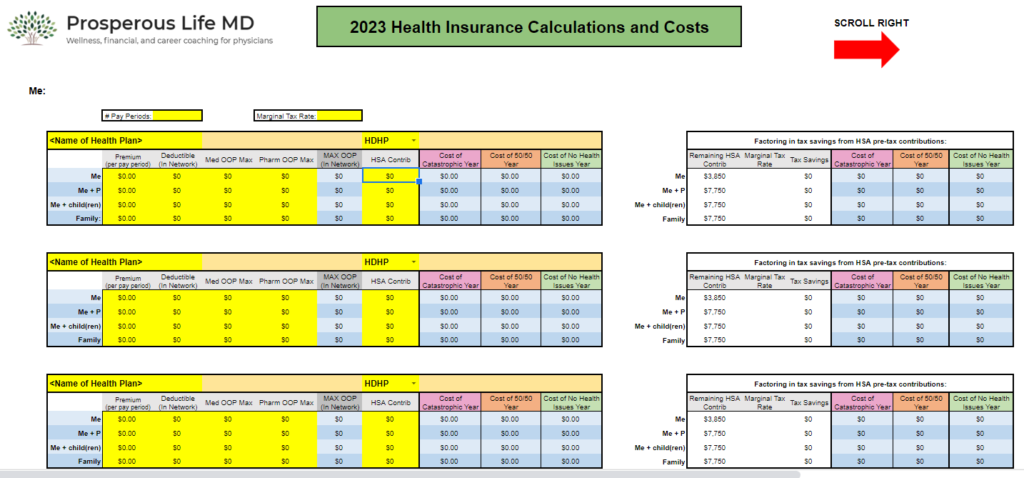

That being the case, I figured I’d share my updated health insurance spreadsheet (that I have loosely termed a calculator) I use every year to see which insurance plan or combo of insurance plans makes the most sense for my family.

What the What?

Yep, I’m still not messing with you. This post will be short and reference what I adapted into a Google Sheet spreadsheet to try to make useful for you.

Without Further Ado

The above screenshot previews what’s in store for you. Click here for the PLMD – 2023 Health Insurance Cost Calculator. (You can also click the screenshot).

The link will take you to a page where you can make a copy that you can customize to your own needs. This is completely free—no need to opt-in (i.e., provide your name and email) to get your hands on this.

It Looks Spiffy, but...

So what does this spreadsheet help with? Glad you asked.

The spreadsheet generally helps you project how much various health insurance plans will cost you so you can make a more informed decision and better plan and budget for your healthcare expenses.

It can show you what you can expect to pay in a “no care utilized” year versus “maxed out care” year. I threw in a 50/50 year just to give a middle of the road estimate as well.

You do have to input all your own numbers, but where I could automate things I tried.

K.I.S.S.

A simple rule of thumb for calculating the most you’d be on the hook for in a given year is to take your annual premiums and add them to your max out of pocket:

Premiums paid + out of pocket maximum = the most you’d have to pay

Don’t be seduced by deductibles. You may actually pay more overall for $0 deductible plans if you’re not careful—it’s a common insurance marketing gimmick.

If You Only Knew the Power of the HDHP/HSA Combo

Briefly, a High Deductible Health Plan (HDHP) is a health plan defined by the IRS as having an annual deductible of no less than $1500 for self-coverage or $3000 for family coverage. The premiums are lower given the higher deductible—that’s the trade-off. There’s also a limit on the out of pocket maximum: not to exceed $7500 for self-coverage or $15,000 for family coverage.

A Health Savings Account (HSA) allows you to save pre-tax money—in 2023 up to $3850 for self-coverage and $7750 for family coverage—and set it aside for health care expenses. HSA money can be invested and rolls over year to year.

My calculator demonstrates how an HDHP coupled with an HSA can save you money, especially if health expenditures are expected to be low.

For example, I made money my first two years of being enrolled (as an individual) in my employer’s HDHP with a HSA! I thankfully did not need to use my health insurance for anything during those years.

Then we had our first kid, put the family on the plan, and blew that all to hell*, but, you know, we got a kid out of it!

* I am being dramatic. It still made the most sense financially even in a year when we incurred moderate costs from having a child.

Here’s the breakdown on how I made money those first two years:

- $22/pay period x 26 periods = $572 in premiums annually

- My employer chipped in $600 to my HSA

- On top of that, I contributed up to the max for an individual HSA

- My contributions to the HSA were tax deductible (in fact, they are super deductible because they come out before even FICA taxes [e.g. Medicare and Social Security] are assessed on your income)

- So my contributions shaved ~$950 off of our taxes at our marginal tax rate

- All told, my health insurance cost me $572 – $600 – $950 = -$978. (The negative number meaning it gave me money).

- Additionally, I got to stash these contributions in a triple tax protected account (meaning the contributions were tax-free, it grows tax-free, and, if used for healthcare expenditures, can be withdrawn tax-free)!

You Know What Assuming Does

It makes a model work.

Here are some of the assumptions/simplifications I made:

- All plans cover your doctors and prescriptions equally (obviously not true).

- The “Cost of a 50/50 year” is simply half the difference between the max out of pocket year added to the no cost year and does not meaningfully reflect actual costs.

- All your care occurs in network. Adding out of network gets too far into the weeds for this spreadsheet.

- Probably the most egregious: users would read the Instructions sheet/tab to figure out how to use the spreadsheet as intended.

Get to It!

I won’t hold it against you if you still don’t find the benefits enrollment period to be as enjoyable as I do. But, who knows, maybe you’ll come around…?

I hope you find this spreadsheet helpful! I know it is not perfect, and I would love any and all constructive criticism and feedback for how I can make it better. I am by no means a spreadsheet maven (I mean, I DID use conditional formatting…), but I know some of you are, so help a novice out! You can comment here or shoot me an email at junaid@prosperouslifemd.com.

If you haven’t subscribed to my email list, then do so below so you don’t miss my new posts or my weekly updates (only for subscribers).

I’d also be most appreciative if you shared this post with anyone whom you think would benefit from the content or message of the blog. They may similarly be most appreciative